Aside from contributing to poverty alleviation, recent trends in the digitization of financial products and services, and the increase in lenders and microfinancing has shown that financial literacy is an essential tool for survival. With easier access to capital and the numerous financial products promising abnormal guaranteed returns, low levels of financial literacy and skills could lead to detrimental consequences not only to an individual but to their future generations, the financial service industry and the economy as a whole. This is a concern that has to be addressed by policy makers, financial service regulators and all stakeholders involved.

Financial literacy could be understood as “a person’s minimal knowledge about financial terms such as money, inflation, interest rate, credit and others, but besides this the abilities and skills of that person to use all this information in personal life, being aware about the consequences of it”.

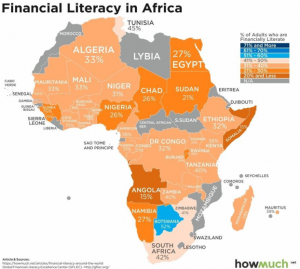

Financial Literacy in Africa

While there are some disparities in terms of economic and human development between African countries, greater majority of the population in African countries have relatively low financial literacy levels. According to S&P’s Global Financial Literacy Survey, African countries score the worst in terms of financial literacy in the world. The most financial literate country is Botswana at 51% and the least is Somalia at 15% according to the survey.

Financial literacy is vital to one’s financial success and that is why an effort has to be made to improve it and prepare Africa’s youth for the future. On the individual level, financial literacy helps one to budget, manage debt, and create a savings and retirement plan. In addition, managing debt and creating savings plans could help reduce household debt levels and take households out of poverty. Ultimately it will put Africa’s youth in control of their money/finances. It will also allow Africa’s youth to confidently participate in the financial market and invest in products that match their financial goals. In terms of the financial system and economy, financial literacy will stimulate economic activities; lead to better regulation of the industry and healthy competition in financial services and products offered. Therefore, it is imperative that policies and measures are put in place to increase financial literacy rate on the continent of Africa.

Stakeholders & Their Roles

There are many stakeholders who play a huge role in promoting financial literacy on the continent. There are stakeholders such as Government agencies, Ministry of Education, Ministry of Finance, the Media, Securities Exchange Commissions, financial institutions, but the government plays the leading role. Beyond the government and government agencies, stakeholders such as the Media, Mobile Money Operators and financial institutions can all play a role in improving financial literacy.

Media:

The media could be used as a medium to spread financial literacy education. In 2018, the number of internet users in Africa went up by more than 20 percent. Compared to 2017, the number of internet users doubled in countries such as Niger, Mozambique and Benin. Ministries of education and government agencies should work with media houses to design and publish simplified and practical articles on financial literacy to educate the public. As many are spending time on the internet, a well-tailored course and or campaign could be used to reach and educate Africa’s youth. Additionally, more airtime and newspaper space should be allocated to financial literacy education.

Mobile Money operators:

As stated earlier, the number of internet users in Africa went up by more than 20 percent in 2018. Most of Africa’s internet user growth was driven by more affordable smartphone and mobile data plans. This provides another opportunity to leverage such platforms to create awareness and understanding in regards to financial literacy. With the rise of mobile money markets and digital financial services, operators are constantly interacting with clients. Mobile Money operators could use their platform to promote sms-based financial literacy courses to complement their existing products and services. In addition to providing courses on their platforms, Mobile money operators could introduce a goal-oriented savings program just like the M-Shwari 52 Week Challenge. One can set a target and an amount they would like to save securely onto a mobile wallet. This will build individuals’ habit of saving and also increase the wallet share of the mobile money operator.

Financial Institutions:

Financial institutions have a major role to play in promoting financial literacy among Africa’s youth. All financial institutions should have improving financial literacy of Africa’s youth as one of their strategic objectives or as part of their corporate social responsibility. As an example, banks are an important part of most people’s life. We turn to the bank for services and advice related to savings, borrowing and investing. Most financial institutions such as banks provide existing and potential customers some educational material and tools to help them make the best financial choices. They can take it a step further by holding workshops where their employees present on pressing topics such as savings, borrowing, managing your finances and many more. Banks do have the capability to create their own financial literacy programs which they can provide to not just their customers but the general public through schools and not-for profit groups. Financial institutions can leverage mobile platforms, print and online media to promote their programs. On the other end, Banks need to ensure that their employees are well trained to understand their customers’ risk tolerance, investment objectives and time horizon so that they can recommend the right products and services for them.

Improving financial literacy is one of the many ways to prepare Africa’s youth for the future. Financial literacy is vital to one’s success. Financial literacy education has to be simplified and made practical. Without simplified and practical financial literacy education, one could fall prey to ill minded lenders, indebtedness and low confidence in managing one’s finances. Ultimately, improving financial literacy amongst Africa’s youth will improve financial inclusion on the continent.

The views expressed in this article are those of the author alone and not the Future Africa Forum.

The views expressed in this article are those of the author and do not necessarily reflect the views of Future Africa Forum. Future Africa Forum is a pan-African policy think-tank and policy advisory consultancy headquartered in Nairobi, Kenya.